Risk Scores

Quickly understand and quantify all physical risks to any property, anywhere in the world

Risk Scores in brief

Regularly updated

Convenient and simplified

Supports risk classification

Instantly understand risk to any individual property or portfolio

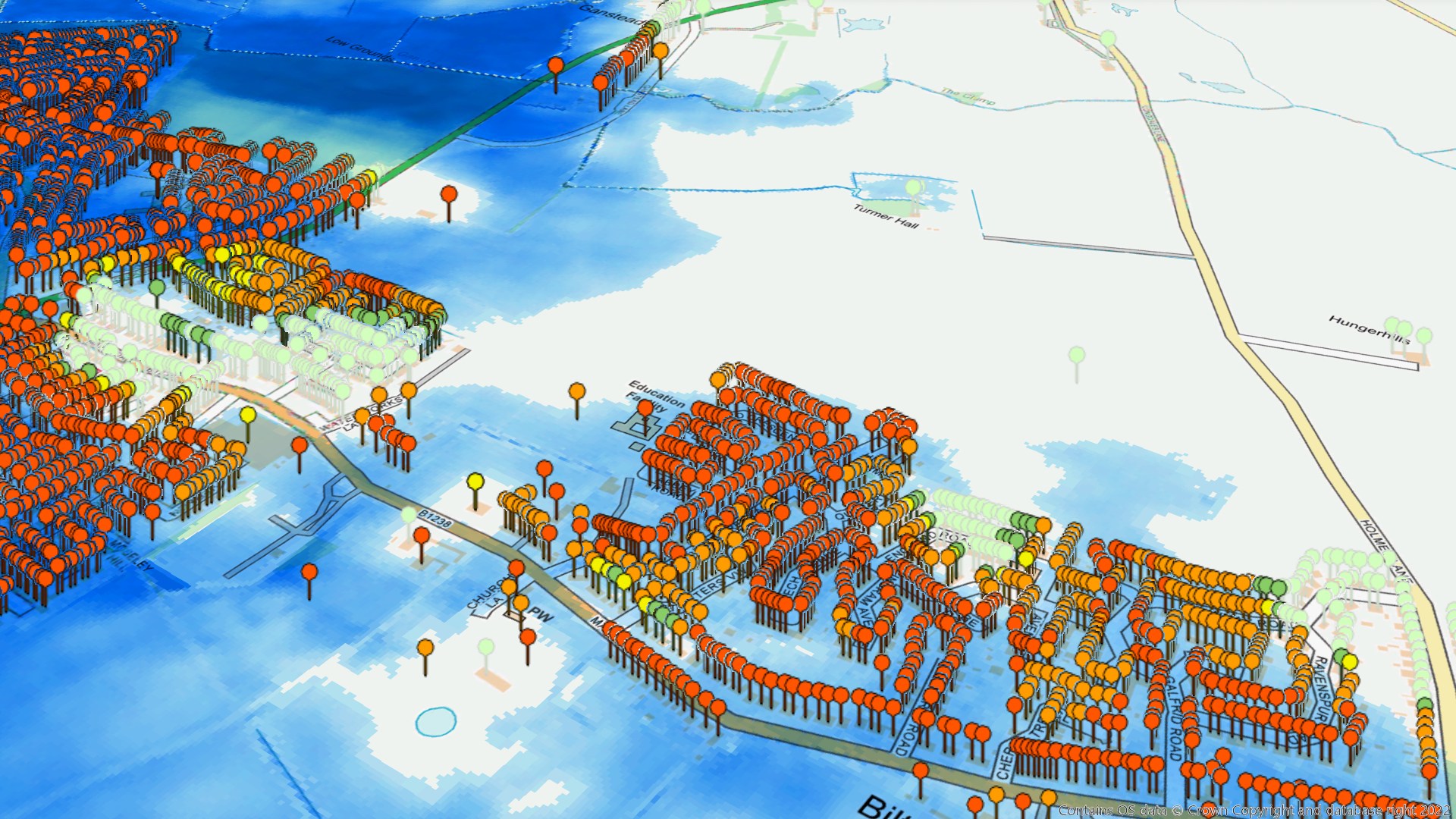

Risk Score provides property-level risk ratings and supplementary information for any property, anywhere in the world. This highly granular data can be used to quickly evaluate and quantify risk from all physical perils at a range of statistical return periods.

Risk Score uses Twinn’s advanced risk indexing algorithms and integrates the most complete and up-to-date hazard data available. It provides a consistent and convenient overall risk rating, for every hazard, whilst also providing insights into the underlying hazard parameters, e.g. flood depth, wind speed and more. It is available as a full or partial database, via our online risk checking service and as spatial layers.

Climate Trend Indicator

Gain essential insights into flood risk influenced by climate emissions for every property in Great Britain, and an excellent introduction into our much richer, full FloodScore Climate database with the Climate Trend Indicator.

Ed Colville,

Underwriter, Ascot Group