How insurers use Twinn to understand, control and mitigate climate risk exposure

Project facts

- MarketInsurance and reinsurance

- LocationUK

- ChallengeUnderstanding the risks associated with climate change and their impact on property portfolios.

- SolutionTwinn climate risk data and analytics

- ImpactInsurers can now accurately manage pricing to reduce risk as well as identify opportunities to take on more risk.

Twinn helps insurance and reinsurance companies understand and price physical risk – now and into the future.

Twinn’s climate risk modelling provides detailed risk ratings and supplementary information. This enables the insurance market to conduct climate risk assessments for individual addresses/ locations, understand and price risk appropriately, avoid adverse claims and manage over-aggregation of risks.

Encompassing high-resolution data, advanced modelling, predictive analytics, machine learning and domain expertise, our proprietary technology enables accurate climate risk scoring and management – while simplifying compliance and reporting.

These two case studies demonstrate how leading insurance companies are leveraging our data, software and domain expertise.

Challenge 1

A leading UK insurer expands into new services

A leading UK provider of general insurance cover required high-resolution hazard risk data to help them break into the home insurance market. “It’s detrimental if we get flood data wrong,” explained a director. “Yet the models we had were preventing us from insuring high flood risk businesses and properties.”They sought a partner to deliver “more value and greater insight into the different complex physical risks,” and found Twinn’s solution from Ambiental Risk Analytics (now known as Twinn). Drawn to our open and responsive approach, the insurer was immediately impressed with our data – when comparing our sample data with claims received, it demonstrated a high level of accuracy and predictability.

Twinn provides accurate climate risk data to support decision-making

Since using our data, the insurer has received fewer flood claims. The data also proved a better match for historical claims than another providers.Our transparency on future development – including the factors considered in model updates – has also impressed the insurance company. “The training workshop and ongoing support give us valuable insight into how Twinn has been involved in other projects,” elaborated the director. “We appreciate being given the opportunity to contribute to model development plans.”

The organisation benefits from Twinn integration with other data providers, as well. As the director said: “Not only does Twinn have extensive flood knowledge and expertise, but their partnerships with other organisations (such as Ordnance Survey and BGS) are excellent at providing us with additional insights we need.”

The insurer has confidence it’s only taking on acceptable flood risk

Leveraging Twinn high-resolution flood risk data, the organisation is now able to make informed decisions about insuring properties across the UK.

“Thanks to the accurate picture of risk Twinn delivers, we have the insight to decide at the individual property level where we do and don’t want to offer insurance cover,” concluded the company director. “Ultimately, we’re now confident we’re only taking on acceptable risks.”

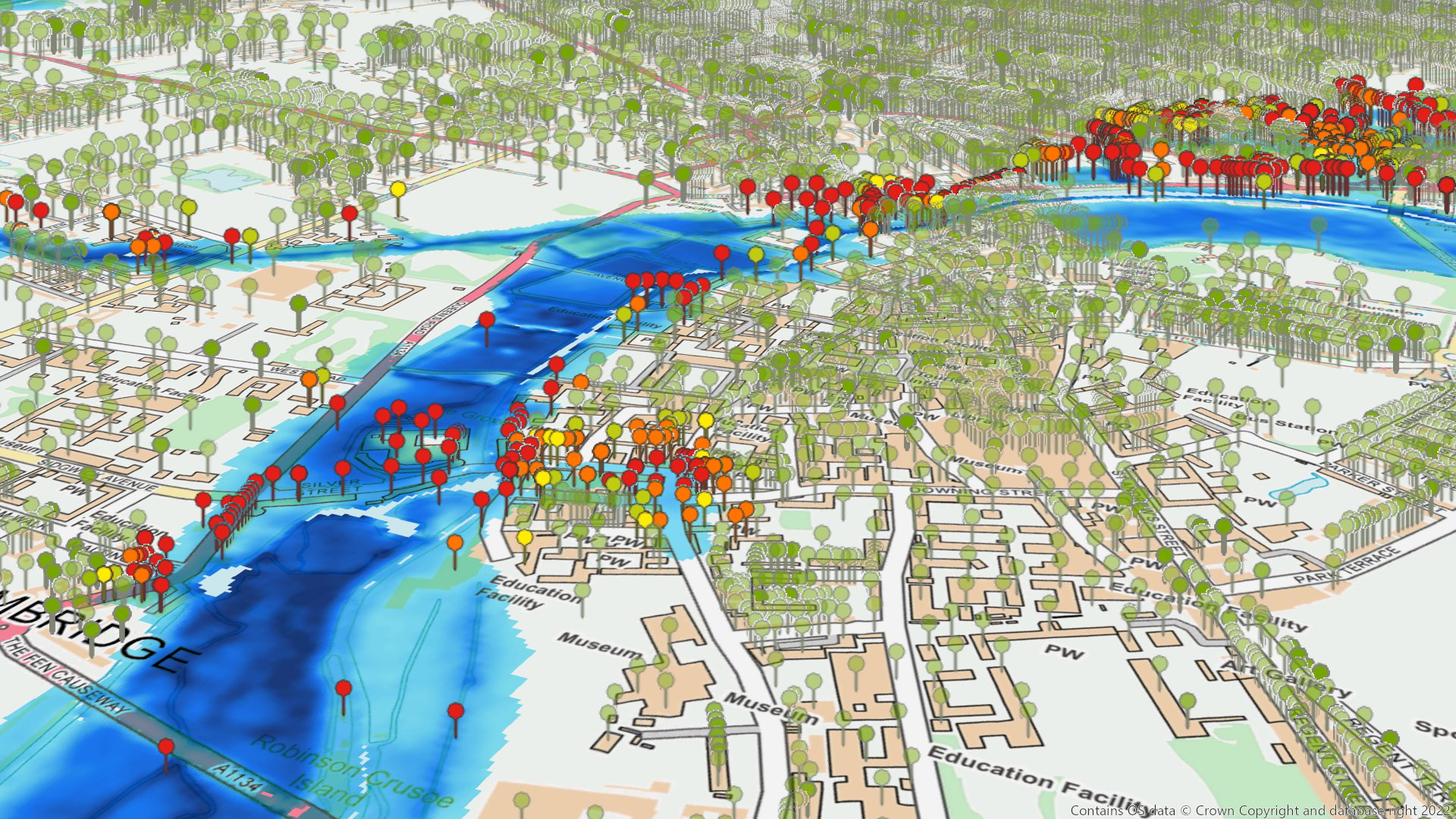

This sample is showing a visualisation of flood risk ratings for a city in the UK.

Challenge 2

A top London insurer reduces flood losses, increases flexibility and simplifies compliance

When researching climate risk data and software solutions, a top City of London insurer approached us.

“Everyone in the London insurance industry is aware of FloodScore Online [formerly born from Ambiental’s renowned flood analytics solution],” said a risk manager. “Our initial approach was made on the basis of your reputation as a market leader in the sector.”

The insurer quickly realised our strong reputation was justified. “We were struck by Twinn excellent pricing, easy and intuitive interface, and the fact that the suite of tools matched our needs,” the risk manager added.

While the insurer had considered more generic providers, it ultimately found those solutions lacked flexibility. “With Twinn l, we only buy what we need, which makes it an incredibly cost-effective option.”

Twinn delivers simple integration and streamlined compliance

Our solution combines high-resolution climate data with advanced modelling and predictive analytics. We integrated seamlessly with the insurer’s systems via an easy-to-deploy API. Importantly, the solution is easy to use. “The intuitive user interface makes it a quick and simple task for anyone in the organisation to access data insights,” commented the risk manager.

Twinn flexibility is also reflected in our licencing approach. The organisation accesses data on a transactional basis, which means they can scale costs based on requirements. In addition, the in-built audit trail has simplified their compliance processes.

The insurer has experienced a decrease in flood losses

Thanks to Twinn data and software, the insurer can now accurately identify high-risk properties. As a result, it’s better able to avoid taking on excessive risk and has experienced fewer flood losses.

By responding quickly to underwriters’ questions – providing explanations and clarification of risk scoring when required – Twinn delivers stand-out customer service. Thanks to our scalable, flexible and cost-effective solutions, the insurance company now has access to the insights it needs to make more informed decisions, streamline processes and improve performance results.

Whitepaper

WhitepaperClimate Stress Testing

An in-depth look at the regulations and opportunities facing European banks and insurers as they demonstrate their resilience to climate change through scenario modelling exercises involving planning and stress testing.

Whitepaper

WhitepaperNow or Never for Financial Services

When it comes to climate risk, a one-size-fits-all approach rarely works. We guide you on where to begin in your journey towards managing climate risk, and protecting your organisation's assets and operations.

Whitepaper

WhitepaperTackling Climate Risk

We examine the issues facing organisations as they look to employ climate data and advanced technology to understand the impact of climate change on their portfolios of physical assets. We reveal the results of our analysis of 10 lender portfolios to assess the scale of the problem for lenders.