The Law Society climate change guidance

– and how to ensure best practice on compliance

In April 2023, the Law Society published new guidance on climate change

While it has previously covered contaminated land and flooding, this is the first time the Law Society has issued guidance on future flood risk and subsidence perils.

This article explores 2 key areas:

- The guidance and its impact on conveyancers and the wider mortgage marketplace –

- Climate risk assessment strategies to comply with the guidance in line with best practices.

The central focus of the new guidance? A duty for conveyancers to disclose climate risks

The Law Society guidance – which you can read in full here – is split into 2 parts:

- Part A centres around how solicitors manage their businesses in the transition to net zero

- Part B refers to solicitors’ duties to advise, warn and disclose climate risks to their clients – and the risk of professional negligence they face if they fail to do so

While the Law Society does not offer detailed insight on strategies to mitigate climate risks, its guidance makes clear that real estate lawyers and conveyancers should clarify if those risks have the potential to impact insurance and lending decisions. This has been interpreted as a requirement to include climate data analysis in conveyancing.

To comply with the guidance, conveyancers need access to accurate, granular climate analysis tools

The Law Society is the first professional legal organisation in the world to issue climate guidance to its members. As such, this milestone moment has generated a significant amount of coverage in conveyancing and lending circles – with top UK environmental and climate data authority (and Twinn partner) Groundsure offering support and guidance to conveyancers.

The UK is facing a hotter, wetter future – with flooding, coastal erosion, landslides and subsidence posing a significant risk to a growing number of properties. Against this backdrop, Groundsure CEO Dan Montagnani welcomed the guidance: “Climate risks – be they physical, transition or liability risks – are already affecting the value of land and buildings in England and Wales,” he said. “The impact these risks have on values is only going to increase. Solicitors will need to ensure that they understand the duties and take practical steps to discharge them.”

To support the roll-out of the guidance, Groundsure have compiled a summary and have already held 2 webinar events – they’re also launching a climate risk microsite for conveyancers as well as arranging training with local law societies.

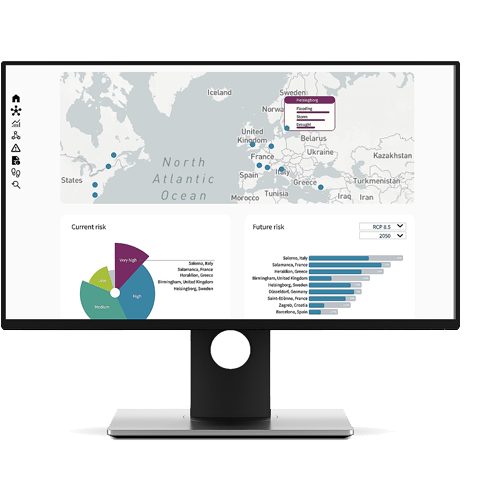

Leveraging Twinn climate data analysis, Groundsure gives conveyancers detailed insight on future climate risks to individual properties

Groundsure uses Twinn Climate Risk Analytics (formerly under the Ambiental brand) to provide flood data to help power its climate analysis tool ClimateIndex™. An integral element of Groundsure’s residential and commercial environmental searches, our data enables conveyancers to provide detail on future climate risks to individual sites – thus ensuring due diligence and compliance with the Law Society guidance.

Encompassing 19 hazards – including coastal, fluvial and pluvial floods – Twinn methodology combines high-resolution natural hazard data with climate exposure analysis, machine learning and risk scoring systems. Crucially, it is able to deliver flood projections up to 80 years into the future, based on different climate change scenarios.

As a result, not only is Groundsure able to give conveyancers an in-depth understanding of risk at an individual property level; it gives them the tools to navigate the complexities of climate risk in an efficient and compliant way, establishing good practice, now and into the future.

Twinn partners with other organisations in the lending sector to deliver clarity on climate risk exposure

This commitment to due diligence when it comes to identifying future climate risk is reflected across the wider mortgage lending and financial services sector. From flooding and coastal erosion to over-heating, subsidence and poor air quality, many lenders already consider a variety of climate-risk factors in their decision-making process.

And while the Law Society may be the first legal organisation to issue climate guidance to members, lenders (and insurers) have already taken steps to comply with the requirements of government and other organisations:

- The PRA Supervisory Statement SS3/19 indicates that climate risk should be embedded in lenders’ governance and management arrangements – and that they should develop an approach to disclosure on financial risks from climate change

- The FCA policy statement PS 20/17 requires lenders to make clear (in their annual reports) whether they have followed the recommendations of the Taskforce on Climate-related Financial Disclosure

- Other measures – a UK government consultation on improving home energy performance, for example – focus on transitional risks and the role of lenders in achieving net zero

For example, Lloyds Banking Group – the UK’s largest lender – leverages our climate risk data via the property company Rightmove Data Services, to quantify physical and transition risk and in reporting. For the second year running, our data has informed its environmental sustainability report. Moreover, to keep its sustainability agenda on track, we help Lloyds adhere to the Bank of England’s regulatory impetus for banks to incorporate climate risks into their risk framework.

Twinn has partnered with numerous organisations in the financial services industry – including Hometrack Data Systems – to deliver clarity on climate risk exposure. Like Groundsure, Hometrack leverages our data and support to power its climate risk analysis tool. And, as detailed in this article, the majority of the UK’s top 10 lenders use Hometrack to ensure compliance with the Climate Biennial Exploratory Scenario (CBES) and to enhance their risk management and ESG strategies.

Want to know more about how we can help you establish best practice for compliance with the latest regulations and guidance on climate change? Get in touch.

![[object Object] [object Object]](https://www.royalhaskoningdhv.com/-/media/images/employees-profile-pics/b/bartholomeusz-ted.jpg?h=500&iar=0&w=500&hash=E0E585C129162309EF962C44FD470621)